UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(A)

of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

| | | |

| ☐ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only |

| þ | Definitive Proxy Statement | | (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Additional Materials | | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | | |

PDL BIOPHARMA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing proxy statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

|

| |

| ☐ | Fee paid previously with preliminary materials. |

|

| | | | |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

932 Southwood Boulevard

Incline Village, Nevada 89451

775-832-8500

April 21, 2016

Dear Stockholder:30, 2019

You are cordially invited to attend our 20162019 annual meeting of stockholders (the Annual Meeting of StockholdersMeeting) on Thursday, June 2, 2016,20, 2019, at 10:3:00 a.m.p.m., Pacific Time, at the Hyatt Regency Hotel, 111 Country Club Drive,The Chateau at Incline Village, 955 Fairway Blvd, Incline Village, Nevada 89451. The meeting will commence with a discussion and voting on matters set forth in the accompanying Notice of 2016 Annual Meeting of Stockholders.

This year we are again taking advantage of the Securities and Exchange Commission rules that allow us to furnish proxy materials to stockholders viaby providing access to these documents on the Internet.Internet instead of mailing printed copies. The rules allow us to provide stockholders with the information they need, while lowering the printing and mailing costs and reducing the environmental impact of delivery.the proxy material and annual report. The printed proxy materials will be sent to stockholders only upon specific request. On or about April 21, 2016,before May 10, 2019, we mailedwill mail our stockholders a noticeNotice of Internet availabilityAvailability of Proxy Materials containing instructions on how to access our 2016 Proxy Statement2019 proxy statement and 2015 Annual Report2018 annual report and how they may cast their vote online.online via the Internet. This information is also available on our website at www.pdl.com.

Your vote is very important. The Noticenotice of 2016 Annual Meeting of Stockholders and 2016 Proxy Statement2019 proxy statement that follow describe the matters we will consider at the meeting. YourIf you received the Notice of Internet Availability of Proxy Materials, a proxy card was not sent to you and you may vote is very important. I urgeonly via the Internet unless you attend the Annual Meeting or request that a proxy card and proxy materials be mailed to you. If you have requested that a proxy card and proxy materials be mailed to you, and you have received those materials, then you may vote by mail, telephone or electronic means via the Internet by following the instructions provided on the proxy card in order to be certain your shares are represented at the meeting,Annual Meeting, even if you plan to attend in person.

I look forward to seeing you at the meeting.Annual Meeting.

John P. McLaughlin

Dominique Monnet

President and Chief Executive Officer

932 Southwood Boulevard

Incline Village, Nevada 89451

775-832-8500

Notice of 20162019 Annual Meeting of Stockholders

Dear Stockholder:

On behalf of the Board of Directors (the Board), I cordially invite you to attend the 20162019 annual meeting of stockholders (the Annual Meeting of StockholdersMeeting) of PDL BioPharma, Inc., a Delaware corporation (the Company), to be held on Thursday, June 2, 2016,20, 2019, at 10:3:00 a.m.p.m., Pacific Time, at the Hyatt Regency Hotel, 111 Country Club Drive,The Chateau at Incline Village, 955 Fairway Blvd, Incline Village, Nevada 89451, for the following purposes:

|

| | |

| 1. | | To elect three Class III directors, each to hold office for a three-year term or until his or her successor is elected and qualified (see page 6); |

| | | |

| 2. | | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 20162019 (see page 17); |

| | | |

| 3. | | To approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in this proxy statement (see page 19); and |

| | | |

| 4. | | To transact such other business as may properly come before the meetingAnnual Meeting and any postponement(s) or adjournment(s) thereof. |

If you wereare a stockholder at the close of business on April 8, 2016,26, 2019, you are entitled to vote at the 2016Annual Meeting. For our Annual Meeting, we have elected to use the Internet as our primary means of Stockholders.providing our proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send to these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our 2019 proxy statement and 2018 annual report, and for voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials free of charge, if they so choose. The electronic delivery of our proxy materials will significantly reduce our printing and mailing costs and the environmental impact of the circulation of our proxy materials.

The Notice of Internet Availability of Proxy Materials will also provide the date, time and location of the annual meeting; the matters to be acted upon at the meeting and our Boards’ recommendation with regard to each matter; a toll-free number, an email address and a website where stockholders may request a paper or email copy of the proxy statement, our annual report to stockholders and a form of proxy relating to the annual meeting; information on how to access the form of proxy; and information on how to attend the meeting and vote in person.

Your vote will be especially important at the Annual Meeting. The Board recommends a vote “FOR ALL” with respect to the election of our Class III director nominees named on the proxy card, and also recommends a vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP and “FOR” the compensation of the Company’s named executive officers. We urge you to vote your shares by proxy, by mail, telephone or via the Internet as soon as possible, even if you plan to attend the meetingAnnual Meeting in person, so that your shares may be represented and voted at the meeting.Annual Meeting or, if you request that the proxy materials be mailed to you, by signing, dating and returning the proxy card enclosed with those materials. For specific instructions on how to vote your shares, please refer to this proxy statement and the noticeNotice of Internet availabilityAvailability of Proxy Materials you received in the mail.

If you plan to attend the Annual Meeting in person, please note that admission will be on a first-come, first-served basis. Each stockholder may be asked to present valid picture identification, such as a driver’s license or passport, and proof of ownership of the Company’s common stock as of the record date, such as the enclosed proxy card or a brokerage statement reflecting stock ownership as of the record date.

By Order of the Board of Directors,

Christopher Stone

Vice President, General Counsel and Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 2, 2016:20, 2019: A complete set of proxy materials relating to our annual meeting isare available on the Internet. These materials, consisting of the Notice of 2016 Annual Meeting of Stockholders, 2016 Proxy Statement, Proxy Card and 2015 Annual Report, may be viewedInternet at www.proxyvote.com withwww. proxyvote.com using the control number provided in the noticeNotice of Internet availabilityAvailability of Proxy Materials you received in the mail.

TABLE OF CONTENTS

Proxy Statement

20162019 Annual Meeting of Stockholders

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

What is the purpose of this proxy statement?

The Board of Directors (the Board) of PDL BioPharma, Inc. (PDL, we or the Company) is soliciting proxies to be voted at the Company’s 2016 Annual Meeting2019 annual meeting of Stockholdersstockholders (the Annual Meeting) to be held at 10:3:00 a.m.p.m., Pacific Time, on Thursday, June 2, 2016,20, 2019, at the Hyatt Regency Hotel, 111 Country Club Drive,The Chateau at Incline Village, 955 Fairway Blvd, Incline Village, Nevada 89451, and at any adjournment of the Annual Meeting. This proxy statement contains important information about the Company, the Annual Meeting and the proposals to be considered at the Annual Meeting. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the proxy card, or follow the instructions below to submit your proxy over the telephone or through the Internet.

Why did I receive a noticeNotice of Internet availabilityAvailability of Proxy Materials instead of a full set of proxy materials?

Pursuant to the rules adopted by the Securities and Exchange Commission (the SEC), the Company has elected to provideuse the Internet as the primary means of furnishing its proxy statement and annual reportmaterials to stockholders over the Internet through a “notice only” option.its stockholders. Accordingly, the Company mailedwill mail a noticeNotice of Internet availabilityAvailability of Proxy Materials (the Notice) on or about April 21, 2016,before May 10, 2019, to its stockholders of record and beneficial owners. The Notice provides instructions on how you may access this proxy statement and the Company’s 2015 Annual Report2018 annual report on the Internet at www.proxyvote.com or request a printed copy of the proxy materials at no charge. In addition, the Notice provides instructions on how you may request to receive, at no charge, all future proxy materials in printed form by mail or electronically by email. Your election to receive proxy materials by mail or email will remain in effect until you revoke it. Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to stockholders and will reduce the environmental impact of its annual meetings on the environment.

What is the “Notice Only” Option?

Under the “notice only” option, a company must post all of its proxy materials on a publicly accessible website. Instead of delivering its proxy materials to stockholders, the company delivers a Notice. The Notice includes, among other matters:

information regarding the date and time of the meeting of stockholders, as well as the items to be considered at the meeting;

information regarding the website where the proxy materials are posted; and

various means by which a stockholder can request paper or email copies of the proxy materials.

If a stockholder requests paper copies of the proxy materials, these materials must be sent to the stockholder within three business days. Additionally, paper copies must be sent via first class mail.meetings.

What will the stockholders vote on at the Annual Meeting?

We are submitting three matters for approval by our stockholders:

|

| | |

| 1. | | To elect three Class III directors, each to hold office for a three-year term or until his or her successor is elected and qualified (see page 6); |

| | | |

| 2. | | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 20162019 (see page 17); and |

| | | |

| 3. | | To approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in this proxy statement (see page 19). |

How does the Board of Directors recommend that I vote?

The Board recommends that you vote your shares “FOR”“FOR ALL” the nominees named herein for directors proposed by the Board, “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP and “FOR” the compensation of the Company’s named executive officers.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on April 8, 2016,26, 2019, the record date, will be entitled to vote at the Annual Meeting. On this record date, there were 165,114,611120,654,947 shares of our common stock outstanding and entitled to vote.were outstanding.

Stockholder of Record: Shares Registered in Your Name

If, on April 8, 2016,26, 2019, your shares were registered directly in your name with PDL’s transfer agent, Computershare Investor Services, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meetingAnnual Meeting or vote by proxy. Whether or not you plan to attend the meeting,Annual Meeting, we urge you to vote by proxy over the telephone, on the Internet as

instructed below, or, if you request printed copies of the proxy materials by mail, to fill outby signing, dating and returnreturning your proxy card enclosed with those materials, to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on April 8, 2016,26, 2019, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name.” The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meetingAnnual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What constitutes a quorum for the Annual Meeting?

The Company’s Third Amended and Restated Bylaws (the Bylaws) provide that a majority of the outstanding shares of our common stock, whether present in person or by proxy, will constitute a quorum for the Annual Meeting. As of April 8, 2016,26, 2019, 120,654,947 shares of our common stock were outstanding. If a majority of the shares outstanding on the record date 165,114,611 shares of common stock were issued and outstanding and, if a majority of these shares are present in person or by proxy at the Annual Meeting, a quorum will be present. Abstentions and broker non-votes are counted as present for determining whether a quorum is present.

How many votes are required for the approval of each item?

There are differing vote requirements for the three proposals:

|

| |

| 1. | The nominees for election as Class III directors will be elected if a majority of shares entitled to vote and present at the Annual Meeting in person or by proxy vote “FOR” each of their elections; provided that if the number of nominees exceeds the number of directors to be elected, a plurality of shares entitled to vote and present at the Annual Meeting in person or by proxy shall be required. If you “Withhold” your vote, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| | |

| 2. | The ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year endedending December 31, 2016,2019, will be approved if a majority of the shares entitled to vote and present at the Annual Meeting in person or by proxy vote “FOR” approval. If you “Abstain”“ABSTAIN” from voting, it will have the same effect as an “Against”“AGAINST” vote. Broker non-votes will have no effect. |

| | |

| 3. | The approval of the advisory vote on the compensation of our named executive officers as disclosed in this proxy statement will require the affirmative vote of a majority of the votes cast in person or by proxy at the Annual Meeting. If you “Abstain”“ABSTAIN” from voting, it will have the same effect as an “Against”“AGAINST” vote. Broker non-votes will have no effect. |

How are abstentions and broker non-votes treated?

Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker non-vote are counted as present and are, therefore, included for purposes of determining whether a quorum of shares is present at the Annual Meeting.

Broker non-votes are not included in the tabulation of the voting results on issues requiring approval of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting and, therefore, do not have an effect on the three matters to be considered at the Annual Meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have the discretionary voting instructions with respect to that item and has not received instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held by them as nominee, brokers have the discretion to vote such shares only on routine matters. Routine matters include, among others, the ratification of auditors. The election of directors and the approval, on an advisory basis, of the compensation of the Company’s named executive officers are considered non-routine matters.

For the purpose of determining whether the stockholders have approved matters other than the election of directors, abstentions are treated as shares present or represented and voting, so abstentions have the same effect as

negative votes. a vote against a proposal. Shares held by brokers who do not have discretionary authority to vote on a particular matter and have not received voting instructions from their customers are not counted or deemed to be present or represented for purposes of determining whether stockholders have approved that matter.

How do I vote?

There are differing voting procedures for the proposals. For proposalProposal No. 1 (Election of Directors), you may either vote “FOR” each“FOR ALL” of the nominees to the Board, or you may “Withhold”“WITHHOLD” your vote for each of the nominees.nominees or you may vote “FOR ALL EXCEPT” certain of the nominees specified by you. For each other proposal, you may either vote “FOR” or “Against”“AGAINST” or abstain“ABSTAIN” from voting.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, vote by proxy on the Internet, or if you request printed copies of the proxy materials by mail, by signing, dating and returning your marked, dated and executed proxy card in the postage-paid envelope provided. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meetingAnnual Meeting and vote in person even if you have already voted by proxy.

To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive.

To vote using the proxy card, simply complete, sign and date your proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number that has been provided with the Notice. Your vote must be received by 11:59 p.m., Eastern Time, on Wednesday, June 1, 2016,19, 2019, to be counted.

To vote on the Internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the control number that has been provided inwith the Notice. Your vote must be received by 11:59 p.m., Eastern Time, on Wednesday, June 1, 2016,19, 2019, to be counted.

If you requested printed proxy materials, to vote using the proxy card, simply sign, date and return your proxy card enclosed with the proxy materials and return it promptly in the postage-paid envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive.

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received voting instructions with these proxy materials from that organization rather than from PDL. You may vote by telephone or over the Internet or use the proxy card as instructed by your broker, bank or other agent. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. Please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted, you have one vote for each share of our common stock you ownedown as of April 8, 2016.26, 2019.

What does it mean if I receive more than one Notice?Notice or proxy card?

If you receivedreceive more than one Notice of Internet Availability of Proxy Materials or proxy card, it generally means that you holdyour shares are registered differently or are in more than one account. To ensure that all of your shares are voted,represented at the Annual Meeting, we recommend that you will needprovide voting instructions for each proxy card or, if you vote via the Internet or by telephone, vote once for each proxy card you receive to voteensure that all of your shares by following the instructions included on each Notice.are voted.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any vote selections, your shares will be voted “FOR”“FOR ALL” the election of each nominee for director, “FOR” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm and “FOR” the approval of the compensation of our named executive officers as disclosed in this proxy statement. If any other matter is properly presented at the meeting,Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of four ways:

You may submit another completed proxy card with a later date.

You may submit new voting instructions via telephone or Internet pursuant to the instructions on the Notice.

You may send a timely written notice that you are revoking your proxy to our Secretary, care of PDL BioPharma, Inc., 932 Southwood Boulevard, Incline Village, Nevada 89451.

| |

| 1. | You may submit new voting instructions via telephone or Internet pursuant to the instructions given in the Notice. |

| |

| 2. | You may submit another completed proxy card with a later date. |

| |

| 3. | You may send a timely written notice that you are revoking your proxy to our Secretary, care of PDL BioPharma, Inc., 932 Southwood Boulevard, Incline Village, Nevada 89451. |

| |

| 4. | You may attend the Annual Meeting and vote in person by ballot. Simply attending the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

Any written notice of revocation or later dated proxy that is mailed must be received before the close of business on June 19, 2019. Alternatively, you may hand deliver a written revocation notice or a later dated proxy to our Secretary at the Annual Meeting before voting begins.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank. Only the latest validly executed proxy that you submit will be counted.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting. The inspector of election will separately count “FOR” and “Withhold”“WITHHOLD” votes with respect to the election of directorsdirectors; and “FOR,” “Against”“AGAINST” and abstentions with respect to the ratification of auditors and the approval of the compensation of our named executive officers as disclosed in this proxy statement. “Withhold” votes (in the case of the election of directors) and abstentionsAbstentions will be counted towards the vote total for the proposals and will have the same effect as “Against”“AGAINST” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

Who will bear the cost of soliciting proxies for the Annual Meeting?

We will pay for the costs of the Annual Meeting, including any cost for mailing the Notices and mailing printed proxy materials upon request and the solicitation of proxies.request. We will also reimburse brokers, custodians, nominees and other fiduciaries for the reasonable out-of-pocket fees and expenses they incur to forward the Company’s solicitation materials to our stockholders. In addition to solicitation by mail, our officers, directors and employees may solicit proxies personally or by telephone, facsimile or electronic means. These officers, directors and employees will not receive any extra compensation for these services.

What is “householding”?

We have adopted “householding,” a practice by which stockholders of record who have the same address and last name will receive only one Notice or, if requested, one copy of our annual report, proxy statement and Noticematerials unless one or more of these stockholders notifies us that they wish to continue receiving separate individual copies. Householding saves printing and postage costs by reducing duplicate mailings to the same address and reduces our impact on the environment. If your household participates in the householding program, you will receive one Notice. If you previously notified us that you wished to continue receiving separate individual copies but now would like to participate in householding, please call or write us at the below phone number or address.

Beneficial stockholders, that is, stockholders whose shares are held by a broker or other nominee, may request information about householding from their banks, brokers or other holders of record.

What if I want to receive a separate copy of the Notice?

If you participate in householding and wish to receive a separate copy of the Notice, or if you wish to receive separate copies of future annual reports, proxy statements and notices, of Internet availability, please call us at 775-832-8500 or write to the address below, and we will deliver the requested documents to you promptly upon your request.

PDL BioPharma, Inc.

Attention: Corporate Secretary (Householding)

932 Southwood Boulevard

Incline Village, Nevada 89451

You can also access our annual reportAnnual Report and proxy statement on our website at www.pdl.com.

How do I contact the Board of Directors or a committee of the Board of Directors?Board?

You may contact the Board or one or more members, by sending a communication in writing addressed to:

Board of Directors

[or individual director(s)]PDL BioPharma, Inc.

Attention: Corporate Secretary

PDL BioPharma, Inc.

932 Southwood Boulevard

Incline Village, Nevada 89451

Our Secretary will maintain a log of such correspondence to the Board and promptly transmit such correspondence to the identified director(s), except where security concerns militate against further transmission or the communication relates to commercial matters not related to the sender’s interest as a stockholder, as determined by our Secretary in consultation with our outside legal counsel.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K once available.

MATTERS FOR APPROVAL AT THE ANNUAL MEETING

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Members of the Board of DirectorsGeneral

Proposal No. 1 concerns the election of three Class III directors. The Board is divided into three classes with each class having a three-year term. The Bylaws provide that the number of directors tothat constitute the Board shall be fixed by a resolution adopted by the affirmative vote of a majority of the authorized directors. That number is currently fixed at seveneight directors. The Bylaws also provide that any vacancy on the Board may be filled by a vote of the majority of the surviving or remaining directors then in office. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is elected and qualified.

The Board presently has seven members:eight members and one vacancy. The members are Harold E. Selick, Ph.D., Paul R. Edick, David W. Gryska, Jody S. Lindell, John P. McLaughlin, Dominique Monnet, Elizabeth G. O’Farrell, Samuel R. Saks, M.D. and, Paul W. Sandman and Shlomo Yanai, with Dr.Drs. Selick Dr.and Saks and Mr. Edick serving as Class III members with terms expiring at the Annual Meeting, Messrs. Gryska and Sandman and Ms. O’Farrell serving as Class I members with terms expiring at the 20172020 annual meeting and Mr.Messrs. McLaughlin, Monnet and Ms. LindellYanai serving as Class II members with terms expiring at the 20182021 annual meeting. The vacancy was created pursuant to resolutions adopted by the Board to expand the size of the Board by one director, pursuant to the Bylaws, in order to nominate Natasha A. Hernday as a Class III director.

Each of our Class III director nominees, Drs. Selick and Saks and Ms. Hernday, has consented to being named in this proxy statement and has agreed to serve as a Class III director if elected. Certain information with respect to these nominees is set forth below. Dr. Selick, who was appointed to the Board in August 2009, and elected Lead Director of the Board in December 2012, Mr. Edick, who was appointed to the Board in September 2015 and Dr. Saks, who was appointed to the Board in September 2015, if reelected at the Annual Meeting, and Ms. Hernday, if elected at the Annual Meeting, will serve until the sooner of the 20192022 annual meeting of stockholders or until such director’s death, resignation or removal. It is the Company’s policy to invite directors and nominees for director to attend the Annual Meeting. All of the directors serving at the time of the 20152018 annual meeting of stockholders, attended such meeting.

Directors are elected by a majority of the votes of shares of the stockholders present in person or represented by proxy and entitled to vote on the election of directors; provided that if the number of nominees exceeds the number of directors to be elected, a plurality of shares of stockholders entitled to vote and present in person or represented by proxy shall be required. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. If a nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee selected by our Nominating and Governance Committee at its discretion. The nominees have agreed to serve if elected and there is no reason to think that they will be unable to serve.

The following is a brief biography of the three nominees and each director whose term will continue after the Annual Meeting.

Nominees for Election for a Three-Year Term Expiring at the 20192022 Annual Meeting

Harold E. Selick, Ph.D., age 61,64, was first appointed a director of the Company in August 2009. Since June 2002,2009 and currently serves as the Chairperson of the Company. Currently, Dr. Selick hasis serving as Vice Chancellor of Innovation and Partnerships at the University of California, San Francisco. Prior to that, Dr. Selick served as Chief Executive Officer and a director of Threshold Pharmaceuticals, Inc., a publicly-traded biotechnology company.company, from June 2002 until April 2017, which was merged into Molecular Templates, Inc. in August 2017, where he serves as Chairman of the Board of Directors. From June 2002 until July 2007, Dr. Selick was also a Venture Partner of Sofinnova Ventures, Inc., a venture capital firm. From January 1999 to April 2002, he was Chief Executive Officer of Camitro Corporation, a biotechnology company. From 1992 to 1999, he was at Affymax Research Institute (Affymax), the drug discovery technology development center for Glaxo Wellcome plc, most recently as Vice President of Research. Prior to working at Affymax, Dr. Selick held scientific positions at Protein Design Labs, Inc. (now PDL BioPharma, Inc.) and Anergen, Inc. As a staff scientist at Protein Design Labs, Inc. (now PDL BioPharma, Inc.), he co-invented technology underlying the creation of fully humanized antibody therapeutics and applied that to PDL’s first product, Zenapax (daclizumab), which was developed and commercialized by Roche for the prevention of kidney transplant rejection. Dr. Selick currently serves as Chairman of the Board of Directors of Catalyst Biosciences, a public drug discovery and development company, as well as Protagonist Therapeutics, a privately-heldpublic biotechnology company. He is alsocompany, and as a member of the Board of Directors of Amunix, a privately-held biotechnology company, and Molecular Templates, Inc., a public biotechnology company. From 2003 until 2018, he also served as Chairman of the Board of Directors of Catalyst Biosciences, a public drug discovery and development company. Dr. Selick received his B.A. and Ph.D. degrees from the University of Pennsylvania and was a Damon Runyon-Walter Winchell Cancer Fund Fellow and an American Cancer Society Senior Fellow at the University of California, San Francisco.

As co-inventor of technology that underlies the Queen et al. patents, Dr. Selick provides the Board with a scientific perspective and a unique appreciation of the Company’s assets. Dr. Selick also provides the Board with operational experience derived from his role as a chief executive officer of a publicly-traded biotechnology company.

Paul R. Edick, age 60, was first appointed a director of the Company in September 2015. Mr. Edick is currently managing partner of 3G Advisors, LLC, a consultancy to the pharmaceutical, healthcare and healthcare investor communities. From July 2010 to

November 2014, Mr. Edick served as chief executive officer and a board member of Durata Therapeutics, Inc. Prior to his term at Durata, Mr. Edick was chief executive officer of Ganic Pharmaceuticals, Inc., a Warburg Pincus investment search vehicle, from March 2008 to June 2010 and prior to that was chief executive officer at MedPointe Healthcare, Inc., a position he assumed in 2006 having been their president of pharmaceutical operations since April 2002. He also held a number of senior positions at GD Searle & Company, and at Pharmacia Corporation following its acquisition of the company, culminating in his appointment as Pharmacia’s group vice president and president, Asia Pacific/Latin America. Mr. Edick holds a B.A. in Psychology from Hamilton College. In the past, he served on the Boards of Directors for Amerita, Inc., Veloxis Pharmaceuticals A/S and Informed Medical Communications, Inc. Currently, Mr. Edick serves on the Boards of Directors for Neos Therapeutics, Inc., Circassia Pharmaceuticals plc and NewLink Genetics Corporation, all of which are public companies. He also serves on the Board of Directors of the private company Iterum Therapeutics Ltd.

Mr. Edick brings to the Board over 35 years of experience in the life sciences industry, including extensive commercial expertise from his chief executive officer positions at several companies, including most recently at Durata Therapeutics, Inc.

Samuel R. Saks, M.D., age 61,64, was first appointed a director of the Company in September 2015. He is a board certified oncologist who is currently the chief development officer at Protagonist Therapeutics, Inc. Prior to that, Dr. Saks most recently served as chief development officer for Auspex Pharmaceuticals, Inc. (Auspex), a position he held from 2013 until it was acquired by Teva Pharmaceuticals Industries, Ltd. in May 2015. He has also served as a board member for Auspex from 2009 to 2015. Prior to Auspex, Dr. Saks was a co-founder of Jazz Pharmaceuticals plc, where he was chief executive officer for six years. Before that, Dr. Saks served as company group chairman of ALZA Corp. (ALZA), and then participated as a member of the Johnson & Johnson Pharmaceutical Group Operating Committee upon the merger of Johnson & Johnson and ALZA. Prior to that, Dr. Saks held various positions with ALZA, most recently as its group vice president. Prior to ALZA, Dr. Saks held clinical research and development management positions with Schering-Plough Corporation, Xoma Corp. and Genentech, Inc. Dr. Saks holds a B.S. in Biology and an M.D. from the University of Illinois. Dr. Saks currently serves on the BoardsBoard of Directors of TONIX Pharmaceuticals Holding Corp. and Depomed, Inc., both of which area publicly-traded pharmaceutical companies,company, as well as on the Boards of Directors of the private companies Bullet Biotechnology, Inc., Velocity Pharmaceutical Development, LLC, and NuMedii Inc., Quanta Therapeutics, Inc. and Hinge Bio, Inc. Dr. Saks served on the Board of Directors of Depomed, Inc., a publicly-traded pharmaceutical company, from October 2012 until March 2017.

Dr. Saks brings over 35 years of experience in biotechnology management to the Board, including extensive product development expertise.

Natasha A. Hernday, age 47, has served as a member of the leadership team of Seattle Genetics, Inc., a publicly-traded biotechnology company, since January 2011. She is currently its Senior Vice President, Corporate Development. At Seattle Genetics, Ms. Hernday built and led the business development team responsible for sourcing, evaluating and negotiating licensing deals, acquisitions and partnerships. From July 1994 until January 2011, Ms. Hernday served in various roles of increasing responsibility at Amgen Inc., including Director, Mergers & Acquisitions and Director, Out-Partnering. Ms. Hernday received her B.A. in microbiology from the University of California at Santa Barbara and her M.B.A. from the Pepperdine University.

Ms. Hernday provides approximately 25 years of biotechnology experience to the Board with particular expertise in corporate development and corporate strategy. Her experience and perspective will be extremely valuable to the Board and the Company’s leadership team.

THE BOARD RECOMMENDS A VOTE “FOR” EACH“FOR ALL” WITH RESPECT TO THE ELECTION OF THE BOARD NOMINEES ANDNAMED ABOVE ON PROPOSAL NO. 1.

PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED IN THE ABSENCE OF

INSTRUCTIONS TO THE CONTRARY.

Directors Continuing in Office until the 20172020 Annual Meeting

Paul W. Sandman, age 68, was first appointed a director of the Company in October 2008. Mr. Sandman served at Boston Scientific Corporation in various management positions from May 1993 to February 2008, most recently as its Executive Vice President, Secretary and General Counsel. From 1981 to April 1993, he served at Wang Laboratories, Inc., most recently as Senior Vice President, General Counsel and Secretary. Mr. Sandman received his A.B. from Boston College and his J.D. from Harvard Law School.

As a former general counsel and executive officer of a major, publicly-traded medical technology company, Mr. Sandman provides the Board with experience in corporate governance and the Litigation Committee with invaluable experience in intellectual property litigation.

David W. Gryska, age 60,63, was first appointed a director of the Company in March 2014. SinceFrom October 2014 to December 2018, Mr. Gryska has beenwas the Vice President and Chief Financial Officer of Incyte Corporation. He served as Chief Operating Officer and a director of Myrexis, Inc., a biotechnology company, from May 2012 to December 2012. From December 2006 to October 2010, he served as Senior Vice President and Chief Financial Officer of Celgene Corporation, a biopharmaceutical company. From October 2004 to December 2006, he was a principal at Strategic Consulting Group, where he provided strategic consulting to early-stage biotechnology companies. Previously, Mr. Gryska served at Scios, Inc. (Scios), a biopharmaceutical company, as Senior Vice President and Chief Financial Officer from 2000 to 2004, and as Vice President of Finance and Chief Financial Officer from 1998 to 2000. Scios was acquired by Johnson & Johnson in 2003. From 1993 to 1998, he served as Vice President, Finance and Chief Financial Officer at Cardiac Pathways, a medical device company later acquired by Boston Scientific Corporation. Prior to Cardiac Pathways, Mr. Gryska served as an audit partner at Ernst & Young LLP (EY). During his eleven years at EY, he focused on technology industries, with an emphasis on biotechnology and healthcare companies. Mr. Gryska holds a B.A. in Accounting and Finance from Loyola University and an M.B.A. from Golden Gate University. HeMr. Gryska has served on the Board of Directors of Hyperion

Therapeutics, Inc. Aerie Pharmaceuticals, Inc. and Argos Therapeutics, Inc. Currently, he also serves on the Board of Directors of Seattle Genetics, Inc. and Aerie Pharmaceuticals, Inc.

Mr. Gryska has over 20 years’ experience as a chief financial officer for several public companies. Prior to these roles, he was an audit partner at EY. Mr. Gryska brings to the Board extensive knowledge of, and experience in, the application of accounting principles and the financial reporting process, particularly, in the health care sciences industry. In addition, Mr. Gryska fills the role of an “Audit Committee Financial Expert”“audit committee financial expert” (as defined in applicable SEC rules) for the Company.

Elizabeth G. O’Farrell, age 55, was first appointed as a director of the Company in June 2018. Ms. O’Farrell previously served 24 years with Eli Lilly and Company, most recently as Chief Procurement Officer from 2012 to 2017. At Eli Lilly, she advanced

through various executive management positions, including Senior Vice President, Policy and Finance; Senior Vice President, Finance; Chief Financial Officer, Lilly USA; Chief Financial Officer, Lilly Canada; and General Auditor. Before joining Eli Lilly, Ms. O’Farrell was an accountant with Boise Cascade Office Products and auditor at Whipple & Company and Price Waterhouse. Currently, she serves on the Board of Directors Continuingof Geron Corporation and Inhibikase Therapeutics, Inc. Ms. O’Farrell served as a Board member of the YMCA of Greater Indianapolis from 2006 until 2017, including as its chairperson from 2014 to 2016. She is a member of the Finance Committee of the United Way of Brevard, in Office untilBrevard County, FL., and previously served on the 2018 Annual MeetingBoards of the Washington Township Schools Foundation and Keep Indianapolis Beautiful. Ms. O’Farrell holds a B.S. in accounting with honors and an M.B.A. in management information systems, both from Indiana University.

Ms. O’Farrell provides the Board with extensive experience as a senior executive of a major pharmaceutical company with global operations. In addition, Ms. O’Farrell has been determined by the Board to be an “audit committee financial expert” (as defined in applicable SEC rules) for the Company.

Jody S. LindellPaul W. Sandman, age 64,71, was first appointed a director of the Company in March 2009. Ms. Lindell isOctober 2008. Mr. Sandman served at Boston Scientific Corporation in various management positions from May 1993 to February 2008, most recently as its Executive Vice President, Secretary and Chief Executive Officer of S.G. Management,General Counsel. From 1981 to April 1993, he served at Wang Laboratories, Inc., an asset management company she has headed since 2000. Prior to that, Ms. Lindell was an audit partner with KPMG LLP. Through September 2007, Ms. Lindell servedmost recently as a directorSenior Vice President, General Counsel and on the AuditSecretary. Mr. Sandman received his A.B. from Boston College and Director’s Loan Committees for First Republic Bank, a publicly-traded financial institution. First Republic Bank was acquired in 2007, underwent a management-led buyout in mid-2010 and again became publicly traded in December 2010. Ms. Lindell continues to serve as a director, the chairperson of the Audit Committee and a member of the Director’s Loan Committee for First Republic Bank. Ms. Lindell has also served as a director of The Cooper Companies since March 2006 and is chairperson of its Audit Committee and member of its Organization and Compensation Committees. She is a Certified Public Accountant (inactive) and holds a B.A.his J.D. from Stanford University and an M.B.A. from the Stanford Graduate School of Business.Harvard Law School.

TheAs a former general counsel and executive officer of a major, publicly-traded medical technology company, Mr. Sandman provides the Board values Ms. Lindell’s extensive accountingwith experience including 25 years’in corporate governance and the Litigation Committee with invaluable experience at KPMG LLP, 16 of which were as an audit partner. Ms. Lindell’s knowledge of accounting principles and financial reporting rules and regulations and oversight ofin intellectual property litigation.

Directors Continuing in Office until the financial reporting process is valued by the Company in her role as a director, the chairperson of the Audit Committee and an Audit Committee Financial Expert.2021 Annual Meeting

John P. McLaughlin, age 64,67, was first appointed a director of the Company in October 2008. Mr. McLaughlin has beenwas our President and Chief Executive Officer sincefrom December 18, 2008 when the Company spun-off Facet Biotech Corporation.until December 2019. From November 6, 2008 until the spin-off,to December 2008 he served as a Senior Advisor to the Company. He was the Chief Executive Officer and a director of Anesiva, Inc., formerly known as Corgentech, Inc., a publicly-traded biopharmaceutical company, from January 2000 to June 2008. From December 1997 to September 1999, Mr. McLaughlin was President of Tularik Inc., a biopharmaceutical company. From September 1987 to December 1997, Mr. McLaughlin held a number of senior management positions at Genentech, Inc., a biopharmaceutical company, including Executive Vice President and General Counsel. From January 1985 to September 1987, Mr. McLaughlin was a partner at a Washington, D.C. law firm specializing in food and drug law. Prior to that, Mr. McLaughlin served as counsel to various subcommittees inof the United States House of Representatives, where he drafted numerous measures that became Food and Drug Administration laws. Mr. McLaughlin co-founded and served as Chairman of the Board of Directors of Eyetech Pharmaceuticals, Inc., a publicly-traded biopharmaceutical company subsequently bought by OSI Pharmaceuticals, Inc., co-founded and served as a director of Peak Surgical, Inc., a private medical device company, until it was acquired by Medtronic in 2011, and served as a director of AxoGen, Inc., a publicly-traded biopharmaceutical company until 2014. Mr. McLaughlin currently serves2014, served as a director of Adverum Biotechnologies, Inc., a publicly-traded biopharmaceutical company, until 2016 and served as a director of Seattle Genetics, Inc., and Avalanche Biotechnologies, Inc.,a publicly-traded biopharmaceutical companies.company, until 2016. He received a B.A. from the University of Notre Dame and a J.D. from Catholic University of America.

Mr. McLaughlin possesses a strong understanding of the biotechnology industry and has experience in development and commercialization of antibodies, corporate licensing and patent litigation that the Company values.

Dominique Monnet, age 60, was first appointed as a director of the Company in December 2018. Mr. Monnet joined the Company in September 2017 as our President and was promoted to President and Chief Executive Officer effective December 31, 2018. Before joining the Company, Mr. Monnet served as senior vice president and chief marketing officer of Alexion Pharmaceuticals from May 2014 to October 2015 where he was responsible for commercial operations in the United States and Latin America and oversaw new products and global business operations functions. From August 2013 to May 2014 he was a managing director at Biotech Advisors International, LLC, a biotechnology consulting firm. Prior to that, from July 2002 through July 2013, he was a senior executive at Amgen Inc. (Amgen) where he served in a number of key commercial leadership positions in the United States and internationally. Most recently he acted as vice president and general manager for Amgen’s Inflammation Business Unit from August 2011 until July 2013, where he was responsible for accelerating the growth of the Enbrel® franchise in the highly competitive U.S. market. Prior to this, he served as vice president and head of Amgen’s Global Marketing and Commercial Development, where he led the marketing strategies and global launches of new products across a range of therapeutic areas. From July 2002 through 2006, Mr. Monnet was based in Zug, Switzerland, where he served as Amgen’s vice president of International Marketing and Business Operations, building Amgen’s international commercial capability and leading the creation of its successful international franchises in oncology and nephrology. Before joining Amgen, Mr. Monnet held positions of increasing responsibility in line commercial management and global marketing over 19 years at Schering-Plough - including General Manager of its affiliate

in the UK and Republic of Ireland - Ciba-Geigy and Alza Corporation. Mr. Monnet holds a business degree from EDHEC Business School in Lille, France, and an MBA from INSEAD in Fontainebleau, France.

Mr. Monnet brings the Board a strong understanding of the pharmaceutical and biotechnology industries and experience in the commercialization of pharmaceutical products. In addition, Mr. McLaughlinMonnet provides strategic guidance to our management team and the Board.

Shlomo Yanai, age 66, is currently the Chairman of the Board of Cambrex Corporation, a publicly-traded life sciences company, and has served on its board of directors since November 2012. Since July 2014, Mr. Yanai has also served as the Chairman of the Board of Protalix BioTherapeutics, a publicly-traded biopharmaceutical company. He also serves as a non-employee member of the board of managers of Q Holdco LLC, a premier manufacturer of precision-molded rubber components, since December 2016, and Clal Industries, a private investment company based in Israel. Mr. Yanai is also currently serving as a senior advisor to Moelis & Company, an investment bank, since October 2016, and as an advisory director of CVC Capital Partners, a private equity and investment advisory firm, since February 2015. Previously, Mr. Yanai served as a director of Lumenis Ltd., a company that provided minimally-invasive clinical solutions for the surgical, ophthalmology and aesthetic markets, from December 2012 through October 2015; Sagent Pharmaceuticals, Inc., a biopharmaceutical company, from April 2015 through August 2016; Perrigo Company plc, a publicly traded global healthcare supplier, from November 2015 through February 2017, and Quinpario Acquisition Corp. a special purpose acquisition company, from November 2014 through July 2017. Mr. Yanai served as President and Chief Executive Officer of Teva Pharmaceutical Industries Ltd. (Teva), a publicly-traded multinational pharmaceutical company, from March 2007 until May 2012, and thereafter served as an advisor to the Chief Executive Officer and board of directors of Teva from June 2012 until December 2015. Prior to that, Mr. Yanai was President and Chief Executive Officer of Makhteshim-Agan Industries Ltd. (n/k/a ADAMA Agricultural Solutions Ltd.) from 2003 until 2006. Before that, he was a Major General in the Israel Defense Forces, where he served for 32 years in various positions, the last two positions being Commanding Officer of the Southern Command and Head of the Division of Strategic Planning. Mr. Yanai was the head of the Israeli security delegation to the peace talks at Camp David, Shepherdstown and Wye River. He currently serves as a member of the Board of Governors of the Technion - Israel Institute of Technology of Haifa, Israel, and of the Board of Trustees of Bar-Ilan University - Israel, as well as an honorary member of the Board of the Institute for Policy and Strategy of the Interdisciplinary Center (IDC), Herzliya, Israel. Mr. Yanai holds a bachelor’s degree in political science and economics from Tel Aviv University, a master’s degree in national resources management from George Washington University, and is a graduate of the Advanced Management Program of Harvard Business School and U.S. National War College (NDU). Mr. Yanai was the recipient of the Max Perlman Award for Excellence in Global Business Management from Tel Aviv University, Israel in 2005 and was awarded an honorary doctorate by Bar-Ilan University, Israel in 2012.

Mr. Yanai’s global operating and leadership experience in the life-science and pharmaceutical industry, including as a senior executive and board member of both public and private companies, makes him well qualified to serve on the Board.

Independence of Directors

As required under the NASDAQNasdaq Stock Market (NASDAQ)(Nasdaq) listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in the applicable NASDAQNasdaq listing standards, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that Ms. Hernday and the following six directors are independent directors within the meaning of the applicable NASDAQNasdaq listing standards: Dr. Selick, Mr. Edick, Mr. Gryska, Ms. Lindell,O’Farrell, Dr. Saks, Mr. Sandman and Mr. Sandman.Yanai. In making these determinations, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company.

Mr. McLaughlin, the Company’s former Chief Executive Officer, and Mr. Monnet, the Company’s President and Chief Executive Officer, isare not an independent director by virtue of histheir employment history with the Company.

The Board, based on the recommendation of the Nominating and Governance Committee, also determined that each member of each of the Compensation Committee, the Nominating and Governance Committee and the Audit Committee was independent during 2015,2018, and is currently independent, under NASDAQ’sNasdaq’s rules for listed companies.

Meetings of the Board of Directors

The Board met 10ten times during 2018. Each member of the last fiscal year. Each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he or she served during the period for which he or she was a director or committee member.

As required under the applicable NASDAQNasdaq listing standards, in fiscal year 2015,2018, the Company’s independent directors met sixseven times in regularly scheduled executive sessions, at which only independent directors were present.

Information Relating to Committees of the Board

The Board currently has the following committees: Audit Committee, Compensation Committee, Litigation Committee and Nominating and Governance Committee.

Audit Committee

The Audit Committee was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the Exchange Act) to oversee the Company’s corporate accounting and financial reporting processes and audits of our financial statements. For this purpose, the Audit Committee performs several functions, including, but not limited to:

overseeing the accounting and financial reporting processes and audits of our financial statements;

appointing an independent registered public accounting firm to audit our financial statements;

overseeing and monitoring (a) the integrity of our financial statements, (b) our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters, (c) our independent registered public accounting firm’s qualifications, independence and performance and (d) our internal accounting and financial controls;

preparing the report that SEC rules require to be included in our annual report or proxy statement;

reviewing all related person transactions for potential conflicts of interests or other improprieties;

discussing our policies with respect to certain risk assessments, including the risk of fraud, our major financial risk exposures and the steps management has taken to monitor and control such exposures;

reviewing our investment policy and evaluating our adherence to such policy with regard to investment of our assets;

providing the Board with the results of its monitoring and recommendations; and

providing the Board additional information and materials as it deems necessary to make the Board aware of significant financial matters that require the attention of the Board.

In 2015, the Audit Committee was comprised of Ms. Lindell, Mr. Gryska and Dr. Selick. The Audit Committee is currently comprised of Ms. Lindell, Mr. Gryska, Ms. O’Farrell and Mr. Edick. Ms. LindellSandman. Mr. Gryska is the chairperson of the Audit Committee. Ms. Lindell and Mr. Gryska and Ms. O’Farrell have each been determined by the Board to be an “audit committee financial expert” as defined by applicable SEC rules. The Audit Committee met nine times during the fiscal year 2015.2018. The Audit Committee has adopted a written charter that is available on the Company’s website at www.pdl.com.

The Board has reviewed the NASDAQNasdaq listing standards definition of independence for Audit Committee members and has determined that all members of the Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A) of the NASDAQNasdaq listing standards).

The audit committeeAudit Committee has the authority to retain special legal, accounting or other professional advisors to advise the committee as it deems necessary, at our expense, to carry out its duties and to determine the compensation of any such advisors.

Report of the Audit Committee of the Board of Directors

The Audit Committee has prepared the following report on its activities with respect to our audited consolidated financial statements for the fiscal year ended December 31, 2015.2018.

Our management is responsible for the preparation, presentation and integrity of our consolidated financial statements. Management is also responsible for maintaining appropriate accounting and financial reporting practices and policies as well as internal controls and procedures designed to provide reasonable assurance that the Company is in compliance with accounting standards and applicable laws and regulations.

The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the Public Company Accounting Oversight Board (PCAOB) in Rule 3200T. PricewaterhouseCoopers LLP has provided the Audit Committee with the written disclosures and letter required by PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees concerning Independence, and the Audit Committee discussed with the independent registered public accounting firm that firm’s independence.

The independent registered public accounting firm is responsible for planning and performing an independent audit of our consolidated financial statements in accordance with auditing standards of the Public Company Accounting Oversight Board (United States) and for auditing the effectiveness of our internal control over financial reporting. The independent registered public accounting firm is responsible for expressing an opinion on the conformity of those audited consolidated financial statements with accounting principles generally accepted in the United States. In this context, the Audit Committee has reviewed and discussed the audited consolidated financial statements for the year ended December 31, 2015,2018, with management and the independent registered public accounting firm, PricewaterhouseCoopers LLP.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015.Report.

Jody S. Lindell (chairperson)

David W. Gryska (chairperson)

Elizabeth G. O’Farrell

Paul R. Edick.W. Sandman.

Compensation Committee

In 2015, the Compensation Committee was comprised of Ms. Lindell, Mr. Sandman and Dr. Selick. The Compensation Committee is currently comprised of Dr. Selick, Mr. Sandman and Dr. Saks. Dr. Selick serves as the chairperson of the Compensation Committee. All members of the Compensation Committee are independent (as independence is currently defined in Rule 5605(d)(2)(A) of the NASDAQNasdaq listing standards). The Compensation Committee met sixfive times during the fiscal year 2015.2018.

The Compensation Committee is responsible for, but not limited to:

reviewing and approving for our chief executive officer and other executive officers: (i) the annual base salary, (ii) the annual incentive bonus, including the specific goals and amount, (iii) equity compensation, (iv) employment agreements, severance arrangements and change in control agreements/provisions and (v) any other benefits, compensation, compensation policies or arrangements;

annually reviewing the effect of the Company’s compensation policies on risk management;

reviewing and approving or making recommendations to the Board regarding the compensation policy for such other senior management as directed by the Board;

reviewing and approving or making recommendations to the Board regarding general compensation goals and guidelines for employees and the criteria by which bonuses to employees are determined;

reviewing with management our Compensation Discussion &and Analysis and recommending that it be included in our annual proxy statement. Our Compensation Discussion & Analysis discusses the compensation awarded to, earned by or paid to our named executive officers, including: (i) the objectives of the Company’s compensation programs, (ii) what each program is designed to reward, (iii) each element of compensation, (iv) why the Compensation Committee chooses to pay each element, (v) how the Compensation Committee determines thestatement; and

amount for each elementapproving and (vi) how each element and the Compensation Committee’s decisions related thereto fit into the Company’s overall compensation objectives and affect decisions regarding other elements; and

acting as administrator of our equity compensation plans, including approving amendments todetermination of the plans (including approving changes in the number of shares reserved for issuance thereunder)terms, conditions and approving the grant or amendmentrestrictions of equity awards issued pursuant thereto.under the plans, the forms of award agreements, the vesting and exercisability of awards and approval of any rules, guidelines or policies related to those equity compensation plans.

While the Compensation Committee maintains the authority to delegate its exclusive power to determine matters of executive compensation and benefits, the Compensation Committee has not done so. The Compensation Committee has adopted a written charter that is available on the Company’s website at www.pdl.com.

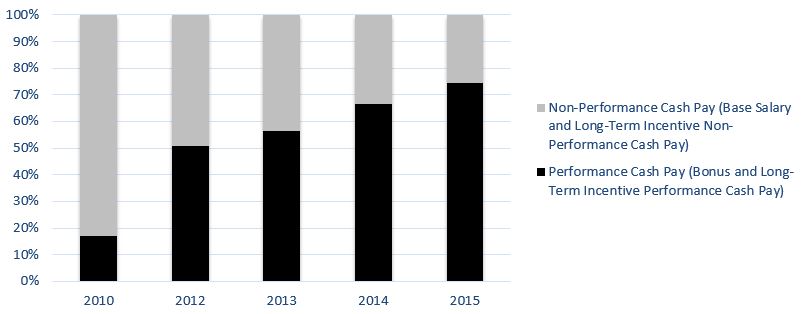

The Compensation Committee retains its own independent compensation consultant. The Compensation Committee retained Setren, Smallberg & Associates through December 2012, Barney and Barney, LLC through December 2013 and Board Advisory, LLC (Board Advisory) from April 2014 onward to advise on various matters related to compensation of executive officers and directors and general compensation programs and matters. This proxy statement discusses in various locations which consultant advised the Compensation Committee on the relevant compensation decisions.

The Compensation Committee generally engages Board Advisory to provide:

comparative market data on the executive and director compensation practices and programs of competitive companies;

guidance on industry best practices and emerging trends and developments in executive and director compensation; and

advice on determining the total compensation of each of our executive officers and the material elements of total compensation, including: (i) annual base salaries, (ii) target cash bonus amounts and (iii) long-term incentives, including restricted stock awards.awards and stock options.

The Compensation Committee has reviewed an assessment of Board Advisory’s independence and any potential conflicts of interest raised by Board Advisory’s work for the Compensation Committee by considering the following six factors: (i) the provision of other services to us by Board Advisory; (ii) the amount of fees received from us by Board Advisory, as a percentage of the total revenue of Board Advisory; (iii) the policies and procedures of Board Advisory that are designed to prevent conflicts of interest; (iv) any business or personal relationship of Board Advisory with a member of the Compensation Committee; (v) any Company stock owned by Board Advisory; and (vi) any business or personal relationship of Board Advisory with any of our executive officers. Based on such review, the Compensation Committee has concluded that Board Advisory is independent and that there are no such conflicts of interest.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee was an officer or an employee of the Company at any time during 2015.2018. None of our executive officers serve as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of the Board or Compensation Committee. Our chief executive officer assists the Compensation Committee by presenting proposals and recommendations to the Compensation Committee, information on Company and individual performance of the named executive officers and management’s perspective and recommendations on compensation matters. Our chief executive officer recuses himself from that portion of the Compensation Committee meetings involving deliberation and decision making of his own compensation.

Litigation Committee

In 2015, the Litigation Committee was comprised of Mr. Sandman, Mr. McLaughlin and Dr. Selick. The Litigation Committee is currently comprised of Mr.Messrs. Sandman Mr. Edick and Mr. McLaughlin. Mr. Sandman is the chairperson of the Litigation Committee. The Litigation Committee met two timesonce during 2015.2018.

The Litigation Committee is responsible for, but not limited to:

consulting with management and outside counsel to discuss the initiation of any dispute by us prior to its commencement or the settlement of any dispute prior to its resolution;

consulting with management and outside counsel following the initiation of a dispute by a third party or an overture by a third party to settle a dispute;

consulting with management and outside counsel regarding the strategy for the management, prosecution and resolution of all disputes;

receiving updates on the status of all disputes; and

assisting the Board in fulfilling its oversight responsibilities with respect to such disputes.

The Litigation Committee has adopted a written charter that is available on the Company’s website at www.pdl.com.

Nominating and Governance Committee

In 2015, the Nominating and Governance Committee was comprised of Ms. Lindell, Mr. Sandman, Mr. Gryska and Dr. Selick. The Nominating and Governance Committee is currently comprised of Dr. Selick Mr.and Messrs. Gryska and Ms. Lindell.Yanai. Dr. Selick is the chairperson of the Nominating and Governance Committee. The Nominating and Governance Committee met sixseven times during 2015.2018.

The Nominating and Governance Committee is responsible for, but not limited to:

identifying individuals qualified to become Board members;

selecting, andor recommending to the Board, director nominees for each election of directors;

developing and recommending to the Board criteria for selecting qualified director candidates;

considering committee member qualifications, appointment and removal;

considering and articulating the qualities, experiences, skills and attributes that qualify each director to be a member of the Board;

assessing the optimum size of the Board and its committees and the needs of the Board for various skills, background and business experience in determining whether it is advisable to consider additional candidates for nomination;

annually assessing the Nominating and Governance Committee’s effectiveness in diversifying the Board;

annually evaluating the effectiveness of the Board’s management structure and articulating why the Board’s current or proposed leadership structure is effective;

recommending to the Board corporate governance principles, codes of conduct and compliance mechanisms applicable to us; and

providing oversight in the evaluation of the Board and each committee of the Board.

The Nominating and Governance Committee has adopted a written charter that is available on the Company’s website at www.pdl.com.

Evaluation of Director Nominations

In fulfilling its responsibilities to select and recommend to the Board director nominees for each election of directors, the Nominating and Governance Committee considers the following factors:

the appropriate size of the Board and its committees;

the perceived needs of the Board for particular skills, diversity, background and business experience;

the skills, background, reputation and business experience of nominees compared to the skills, background, reputation and business experience already possessed by other Board members;

the nominees’ independence from management;

the applicable regulatory and listing requirements, including independence requirements and legal considerations, such as antitrust compliance;

the benefits of a constructive working relationship among directors; and

the desire to balance the considerable benefit of continuity with the periodic injection of a fresh perspective provided by new members.

The Nominating and Governance Committee’s goal is to assemble a board of directors that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience. Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the best interests of our stockholders. They must also have an inquisitive and objective perspective and mature judgment. Director candidates, in the judgment of the Nominating and Governance Committee, must also have sufficient time available to perform all Board and committee responsibilities. Board members are expected to prepare for, attend and participate in all Board and applicable committee meetings.

The Nominating and Governance Committee has defined “diversity” for purposes of evaluating director candidates. Under the Nominating and Governance Committee’s selection criteria, diversity means experience, professional skill, geographic representation and educational and professional background necessary to assist the Board in the discharge of its responsibilities. The Nominating and Governance Committee looks at the composition of the Board as a whole when considering diversity and seeks nominees whose experience, professions, skills, geographic representation and backgrounds complement and create diversity among the directors. The Nominating and Governance Committee does not assign specific weights to any criteria and no particular criterion is necessarily applicable to all prospective nominees.

The same standards apply to any nominee, regardless of whether recommended internally or by stockholders.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating and Governance Committee may also consider such other factors as it may deem to be in the best interests of the Company and our stockholders. The Nominating and Governance Committee annually evaluates all Board members and the Board as a whole. It also evaluates those directors whose terms expire that year and who are willing to continue in service against the criteria set forth above in determining whether to recommend those directors for reelection. The Nominating and Governance Committee has determined that the Board and its members meet such criteria.

Candidates for Nomination

Candidates for nomination as director come to the attention of the Nominating and Governance Committee from time to time through incumbent directors, management, stockholders or third parties. These candidates may be considered at meetings of the Nominating and Governance Committee at any point during the year. Such candidates are evaluated against the criteria set forth above. If the Nominating and Governance Committee determines at any time that it is desirable for the Board to consider additional candidates for nomination, the Nominating and Governance Committee may poll directors and management for suggestions or conduct research to identify possible candidates and may, if the Nominating and Governance Committee deems it is appropriate, engage a third-party search firm to assist in identifying qualified candidates.

The Nominating and Governance Committee has adopted a policy to evaluate any recommendation for director nominee proposed by a stockholder, and our Bylaws also permit stockholders to nominate directors for consideration at an annual meeting, subject to certain conditions. Any recommendation for a director nomination must be submitted in writing to:

PDL BioPharma, Inc.

Attention: Corporate Secretary

932 Southwood Boulevard

Incline Village, Nevada 89451

Our Bylaws require that any director nomination made by a stockholder for consideration at an annual meeting must be received in writing not less than 90 calendar days nor more than 120 calendar days in advance of the date of the one-year anniversary of the Company’s (or the Company’s predecessor’s) previous year’s annual meeting of stockholders.

Each written notice containing a stockholder nomination of a director at an annual meeting must include as to the stockholder submitting the nomination:

the name and address, as they appear on the Company’s books, of such stockholder and the name and address of the beneficial owner, if any, on whose behalf a proposal of nomination to election of directors is made;

the class, series and number of shares of capital stock of the Company that are owned beneficially and of record by such stockholder and such beneficial owner;